putnam county property tax bill

Is the value upon which taxes are based in the following year ie. The property maps represented on this site are compiled from information maintained by your local county Assessors office and are a best-fit visualization of how all the properties in a county relate to one another.

Putnam County Tax Assessor S Office

The median annual property tax payment in Jasper County is 899.

. LaPorte County collects on average 087 of a propertys assessed fair market value as property tax. The median property tax in LaPorte County Indiana is 1047 per year for a home worth the median value of 119800. Search Assessed Value Database.

In other words for the tax bill you. Marys-Palatka FL-GA Combined Statistical AreaThe county is centrally located between Jacksonville. Click the button for more search options.

Notice of Certification of the 2021 Tax Rolls. Our goal is to make this information available as soon as possible but please be aware. Online versions of Putnam County FL Documents and Forms are posted for your convenience only.

The countys average effective tax rate is 078. Discounts are extended for early payment. Click the button to clear results window and map highlighting.

North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina. Search Sales Disclosure Database. Indiana is ranked 1416th of the 3143 counties in the United States in order of the median amount of property taxes collected.

The property lines are determined by examining detailed property descriptions on deeds and by using surveys created by a. Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. Its county seat is Palatka.

Putnam County comprises the Palatka FL Micropolitan Statistical Area which is included in the Jacksonville-St. The property owner must agree to and understand the following. Documents and Forms Disclaimer.

Notice of ReCertification of 2021 Tax Rolls. This section provides information on property taxation in the various counties in Georgia. Fairfield County Property Records are real estate documents that contain information related to real property in Fairfield County Connecticut.

PROPERTY OWNER BILL OF RIGHTS. The goal of the Putnam County Assessors Office is to provide the people of Putnam County with a web site that is easy to use. North Carolinas median income is 55928 per year so the median yearly property.

Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session. Rates in Jasper County are likewise relatively low. Looking for FREE property records deeds tax assessments in Orange County NY.

123 N Main St 850 main st ferdinand Walnut St3rd St 19-06-35-102-218000-002 john smith holiday lake kellerville rd mcdonalds Click the button to recall previous search results. You can search our site for a wealth of information on any property in Putnam County. County Tax Bill Calculator.

Putnam County is a county located in the northeastern part of the state of FloridaAs of the 2020 census the population was 73321. The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. The Putnam County Tax Commissioner should be contacted with tax bill related questions at 706-485-5441.

Ad Pay Your Taxes Bill Online with doxo. Ad Find Out the Market Value of Any Property and Past Sale Prices. The Monroe County Tax Collector also accepts partial payments with a signed affidavit found on the back of the tax bill or contact our office at 305 295-5070 for a copy of the affidavit per Florida Statute 197374.

Quickly search property records from 30 official databases. Located in western Missouri the Cass County average effective property tax rate is 107. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Base tax is calculated by multiplying the propertys assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Thats about the national average. The tax rates are expressed as dollars per 100 of assessed value therefore the tax amount is already divided by 100 in order to obtain the correct value.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Filing a property tax return homestead exemptions and appealing a property tax assessment.

April S Marketwatch Is In Look At That Interest Rate Indiana Marketing Things To Sell

Property Appraiser Putnam County Florida

20 Garden Street Brewster Ny 10509 Special Purpose Other Property For Sale On Loopnet Com Brewster Property For Sale Garden

Property Appraiser Putnam County Florida

Good Thing You Didn T Sell Your Home Last Year Residential Real Estate Real Estate Humor Us Real Estate

Putnam County Property Tax Inquiry

The Old Bookworm Book Store Originally A 7 Eleven Ne Corner Of Palm St Johns Palatka Property Records Old Photos

Pay Taxes Kanawha County Sheriff S Office

Putnam County Tax Assessor S Office

Sample Property Tax Bill Polk County Tax Collector

110 S State Road 19 Palatka Fl 32177 Palatka Florida Palatka Florida

Under 75k Thursday Update C 1930 Welaka Florida Handyman Special Near St John S River Reduced To 65k Old Houses Old Houses For Sale Porch Lanterns

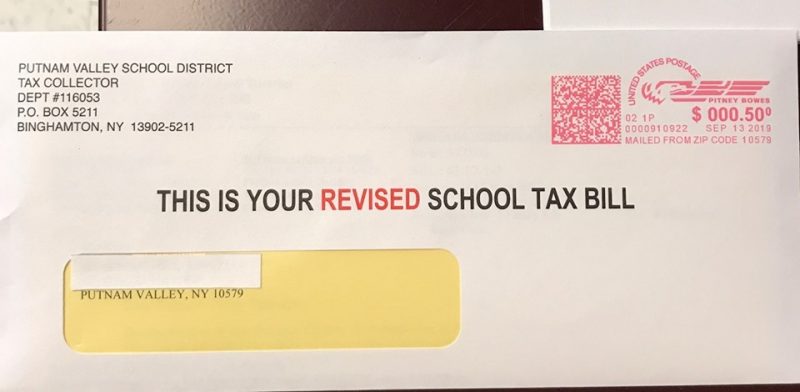

Tax Bill Error Leads To Confusion Throughout Putnam County The Examiner News

Putnam County Tax Assessor S Office